Given the limited supply and high price of battery-grade lithium and other advanced battery materials, alternative battery chemistries are being researched. Some avenues, such as sodium-ion batteries, are yielding the first tangible results. Sodium-ion batteries are one of the most developed technologies today and have the potential to become a viable option in many battery applications in the near future.

The initial commercial success of sodium-ion batteries indicates a potential for substantial growth in this segment. However, new battery technology requires years of engineering for successful commercialization, and with the accelerating demand, there remains a risk of battery shortages in the mid-term future.

Sodium-ion battery technology is commercially available

CATL, one of the world’s biggest lithium battery manufacturers, is launching commercial-scale manufacturing of sodium-ion (Na-ion) batteries to be used in passenger EVs. This may indicate the early market adoption and growth potential for sodium-ion chemistry, replacing lithium-ion (Li-ion) in some battery applications. In this article, we compare the two technologies’ various parameters and contemplate the feasibility of using sodium-ion batteries in industrial machinery, such as material handling equipment and other applications.

Chemical element comparison: sodium vs lithium

Abundance

The natural abundance of sodium (Na), the Earth’s 5th most abundant element constituting 3% of its mass, is remarkably higher than that of lithium (Li), signifying its potential significance in battery production. The concentration of sodium in the Earth’s crust is approximately 1180 times greater than that of lithium, and in the sea, it is an astonishing 60,000 times higher. These stark differences in availability are presented in Table 1:

| Crust (mg/kg or ppm) | Sea (mg/L or ppm) | |

|---|---|---|

| Sodium (Na) | 2.36 × 104 | 1.08 × 104 |

| Lithium (Li) | 2.0 × 101 | 1.8 × 10-1 |

Table 1. Na and Li in the Earth’s crust and in the sea. Source: CRC Handbook of Chemistry and Physics 103rd Edition (2022-2023)

Cost

One significant advantage lies in the cost of sodium. A simple comparison of prices on the Shanghai Metals Market reveals a striking 20-fold difference in prices of pure sodium and lithium compounds (June 2023):

- Sodium carbonate costs approximately $290 per metric ton.

- Lithium carbonate (99.5% battery grade), on the other hand, commands a significantly higher price of approximately $35,000 per metric ton (even after a sharp decline since mid-July 2022).

The current demand for sodium within the battery industry is negligible, especially in contrast to the surging demand for lithium in Li-ion battery packs. The year 2022 marked a notable milestone for lithium-ion batteries, as the prices of battery packs increased for the first time in 12 years since BloombergNEF (BNEF) began tracking prices. The price reached $151 per kWh, largely due to the soaring demand for batteries driven by the electrification of passenger electric vehicles (EVs), as well as electrical industrial equipment and energy storage manufacturing.

Sodium-ion vs lithium-ion battery cell

Structure of sodium-ion and lithium-ion battery cells

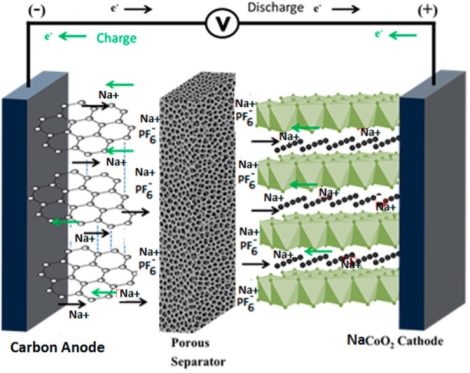

Similar to lithium-ion cells, sodium-ion battery cells have positive and negative electrodes, a separator, and an electrolyte. Both battery types are based on the «rocking chair» principle: during the charging and discharging processes, positive ions travel back and forth between the two electrodes of the battery, as shown in Figure 1.

Figure 1. Representation of a sodium-ion battery cell.

Similar to the early days of lithium-ion batteries, sodium-ion batteries also utilize a cobalt-containing active component. Specifically, sodium cobalt oxide (NaCoO2) is used as the primary active material for sodium-ion cells, mirroring the use of lithium cobalt oxide (LiCoO2) in lithium-ion cells. However, as technology advanced and concerns arose about the sustainability and cost of cobalt, the industry began exploring alternatives. In lithium-ion batteries, cathode materials like NMC (nickel manganese cobalt) and NCA (nickel c a) are increasingly being substituted with more abundant and cost-effective LFP (lithium iron phosphate) chemistry. Similarly, researchers and manufacturers are actively working towards substituting cobalt-containing compounds in sodium-ion battery cathodes with more sustainable and economical elements.

For a comprehensive understanding of these components and their roles in sodium-ion battery cells, read our article What’s Inside the Black Box? The Form, Design, and Chemistry of Lithium Forklift Battery Cells. Although this article concerns lithium-ion batteries, the fundamental principles of electrolyte and integrated separator functionality fully apply to sodium-ion batteries.

Sodium-ion and lithium-ion battery cell performance

Similarities in specific energy between Na-ion and LFP cells make sodium-ion batteries potentially well-suited for applications currently using LFP battery packs, such as industrial batteries. Such applications include EVs, e-buses, industrial and off-highway vehicles, stationary storage, marine and rail transport, and power tools.

However, it remains to be seen whether the actual performance of batteries on a pack level differs significantly from what is reported on a cell level, as we highlighted in this article: Cell-to-pack LFP Lithium Batteries Outperform NMC. We will need to see Na-ion battery packs’ performance in real life to confirm their data on the number of cycles before degradation, loss of capacity in extreme cold and hot conditions, and other specs.

| Parameter | Sodium-ion (Na-ion) | Lithium-ion (LFP) |

|---|---|---|

| Lifetime | 2000–6000 cycles | 3000 cycles |

| Cell voltage | 2.8–3.5 V | 3.0–4.5 V |

| Low temperature performance | At -20 °C capacity retention rate is above 90% | At -20 °C capacity retention rate is above 70% |

| Safety | An aluminum anode current collector allows cells to be deeply discharged. | Over-discharge can lead to the dissolution of copper current collectors. |

| Specific energy (Wh/kg) | 120–190 | 93–186 |

Table 2. Overall comparison of sodium-ion cells against Lithium-ion cells. Sources: “A non-academic perspective on the future of lithium-based batteries (Supplementary Information)”; “Sodium-ion Batteries 2023-2033: Technology, Players, Markets, and Forecasts”.

Sodium-ion battery pack advantages

Sustainability

The abundance of Sodium (Na) in the world’s oceans presents a compelling opportunity for large-scale sodium extraction, leveraging existing technologies. Presently, brine extraction on the mainland, followed by water evaporation, chemical separation of sodium-containing salts, and subsequent chemical recovery of sodium, is a commonly employed method. However, future advancements could replace this approach with the desalination of seawater, offering the advantage of clean drinking water as a by-product of sodium extraction. This innovative technology has already been extensively discussed in Nature. Further development of this technology, such as anode-free sodium metal batteries, can help reduce the carbon footprint and energy use during battery manufacturing and recycling processes.

Lower cost of a battery pack

The specific price for sodium-ion battery packs is lower today and is expected to decrease as production volume grows and further advancements in technology are made. Unlike lithium, there is no foreseeable shortage of raw sodium.

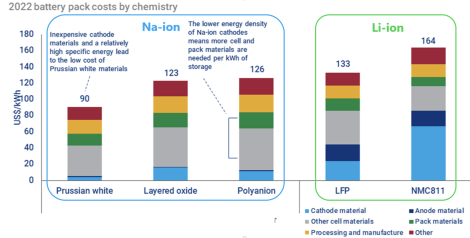

Figure 2 shows a price comparison for different types of batteries:

Figure 2. Prices for different types of batteries per energy unit. Source: Wood Mackenzie, 2022 Battery pack prices per energy unit

However, as per the Global EV Outlook 2023 by the International Energy Agency, Na-ion batteries currently do not offer the same energy density as Li-ion. With energy densities ranging from 75 to 160 Wh/kg for sodium-ion batteries compared to 120–260 Wh/kg for lithium-ion batteries, there exists a disparity in energy storage capacity. This disparity may make sodium-ion batteries a good fit for off-highway, industrial, and light urban commercial vehicles with lower range requirements, and for stationary storage applications. These applications prioritize cost-effectiveness and sustainability over maximizing the driving range important in a passenger EV.

Gigafactories can be retrofitted to produce Na-ion cells relatively quickly

Sodium-ion Batteries 2023-2033: Technology, Players, Markets, and Forecasts argues that Na-ion is a drop-in technology for the current production lines of Li-ion batteries. This means that if sodium batteries will indeed start to replace lithium in some applications, manufacturers can switch to the new chemistry very fast.

Sodium-ion batteries for material handling equipment (MHE)

Material handling equipment has specific requirements based on the particulars of its applications:

- Industrial equipment utilization rates are high, with up to 18 work hours per day and short breaks. Automated equipment such as AMRs and AGVs can work even more hours per day.

- Chargers are typically located within the facility of operation, and there is no “range anxiety,” as batteries can be frequently and rapidly charged during scheduled and random breaks.

- A harsh industrial environment requires the equipment to withstand extreme temperatures, vibration, and moisture.

Given these specific requirements, MHE requires lower specific battery energy (Wh/kg) but higher specific power (W/kg) compared to passenger EVs. If sodium-ion technologies can meet the challenge of delivering higher power and durability, they may indeed have a bright future in the MHE industry. And unlike with an EV, extra battery weight is often welcome as a counterweight in some trucks. A simultaneous development of demand for lithium-ion and sodium-ion forklift batteries is quite possible, and sodium-ion battery packs becoming a direct competitor to TPPL lead-acid batteries, which are currently used in applications with lower power demands.

Conclusion. Active manufacturers of sodium-ion batteries

According to IEA’s Global EV Outlook 2023, there are nearly 30 sodium-ion battery manufacturing plants currently operating, planned, or under construction, for a combined capacity of over 100 GWh, and almost all of them are in China. For comparison, the total US manufacturing capacity of lithium-ion batteries in 2022 is estimated at 110 GWh.

Within the next few years, we will see if this new technology can be scaled and achieve wide commercialization, or if it will remain a niche product along with many other battery chemistries. Below are a few key players that have made significant progress in the development and commercialization of sodium-ion batteries.

CATL. In July 2021, CATL confirmed the launch of sodium-ion products, signaling their entry into the sodium-ion battery market. In April 2023, CATL announced that Chery passenger cars will be equipped with its EV sodium-ion batteries, indicating massive commercial adoption.

BYD. In December 2022, BYD said it will mass-produce sodium-ion batteries and incorporate them into their Qin EV, Dolphin, and Seagull models. Other Chinese developers racing to launch sodium batteries for EVs are Farasis Energy and HiNa Battery.

Tiamat. Tiamat is an American start-up focused on designing, developing, and producing sodium-ion technology. The company achieved significant milestones, including the launch of the first 18650 Na-ion cell in November 2015. Today Tiamat is working on the construction of a gigafactory on French soil in the coming years.

Faradion. The British sodium-ion battery technology company Faradion was acquired by Reliance New Energy Solar (RNES) in India (read more about the recent lithium battery companies’ mergers and acquisitions). In December 2022, Faradion completed its first sodium-ion battery energy storage installation, showcasing progress in the commercialization of its technology.

Natron Energy. Based in California, Natron Energy is a start-up specializing in sodium-ion batteries. United Airlines is among its investors. Natron is targeting data centers and telecom applications. In April 2021, Natron Energy and Lonza Specialty Ingredients (LSI) announced their agreement for LSI to supply high volumes of Prussian blue materials for Natron’s sodium-ion energy storage products.